| About: The United (USO)

Summary

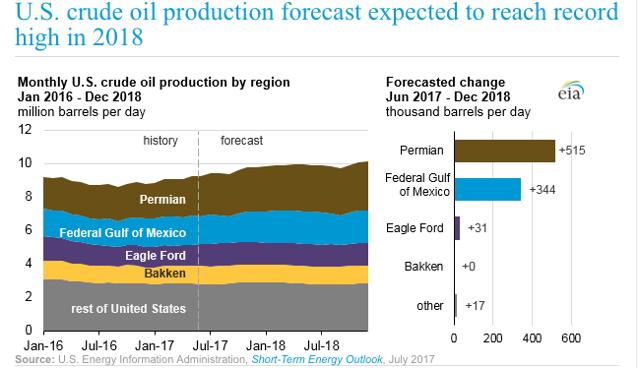

In 2017 and 2018, US oil production growth stems from Permian and Gulf of Mexico production increases.

New research highlights that U.S. shale is competitive and plentiful.

Oil prices have been supported by OPEC production quotas and market forces, but anything can happen.

Global growth is expected to offer tailwinds in 2018, however.

In 2009, in the aftermath of a large financial crisis, U.S. shale oil from the Bakken and then the Eagle Ford Shale began to flow in earnest. Today, analysts and academics are still trying to determine the volumes of shale oil and gas that are technically recoverable, but it is that portion which is economically recoverable that matters most.

Projections about U.S. oil production continue to rise in an upward fashion. Recently, the Energy Information Administration estimated oil production would reach an average of 9.3 million barrels per day and increase to 9.6 million in 2018. A large part of this rise is expected to be from the Permian Basin and the Gulf of Mexico.

As of October 31, West Texas Intermediate futures traded at the $54 mark and Brent, the global benchmark, at $60. OPEC is expected to continue its production quotas, along with Russia. The Saudi crown prince Mohammed bin Salman is reported to be continuing to support the measure even until the end of 2018. The Kingdom appears to be steadily honoring its word about economic reforms with actions that follow. But the region is still quite volatile, and anything can happen.

Shale’s many faces

Many have thought that U.S. shale would eventually peak and decline, given the way in which shale oil and gas wells deplete rapidly early on. Shale-oriented firm CEOs such as now retired Scott Sheffield indicated years back that experience from the gas-producing Barnett Shale suggested wells would produce for 20, 30, or more years. This relates to the longevity of wells. More analysis about the potential of shale oil and gas has flowed regarding the productivity variations in shale oil wells within a play (estimated ultimate recoveries or EURs) and the breakevens considering all-in costs (and an 8.5% discount rate).

New research about shale oil wells illuminates the economically recoverable volumes of shale oil at given break-even points for four oil-producing basins: the Permian’s Midland Wolfcamp, the Williston Basin’s Bakken core, the Eagle Ford, and the Anadarko Basin’s Marmaton. The research is based on the technologies available at mid-year 2015. The Midland Wolfcamp modeling suggests the following:

• At oil prices of $20 per barrel, the estimated volume of Midland Wolfcamp oil reserves that could be economically recovered would be approximately 10.6 billion barrels;

• That volume rises to 13.8 billion barrels at $40 oil;

• And, 17 billion barrels at $100.

These results have implications specifically for Pioneer Natural Resources (PXD), RSP Permian (RSPP), Apache (APA), Diamondback Energy (FANG), Energen (EGN), Parsley (PE) and others with Midland Basin Wolfcamp wells.

The Bakken case study mentioned in the research profile is based on drilling results observed in the North Dakota portion of the Bakken play during 2006-2015. During that period, a total of 12,376 horizontal fractured shale oil wells were drilled in North Dakota. The Bakken paper plays the 2015 tech level forward, allowing for technological advances, which includes experience/learning, and costs.

• 50% of remaining technically recoverable resources located in the Bakken play – roughly 8 billion barrels – could be developed economically if the oil price remains near $50 per barrel.

The research has implications for Continental Resources (CLR), Hess (HES), Exxon Mobil (XOM), and Whiting Petroleum (WLL), all players with large Bakken acreage. Exxon Mobil’s XTO Energy, its shale arm, also is a top oil producer in the Permian.

According to the analysis of the research, these estimates are conservative.

Looming large

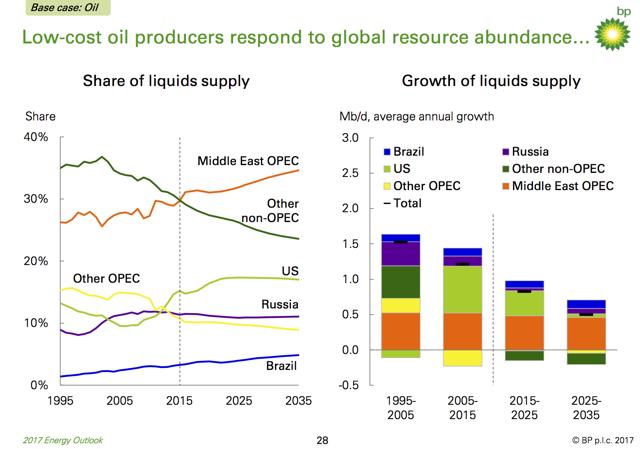

As noted in an earlier article, lower cost producers take the lion’s share of global oil supply in the years ahead, even if oil demand slows. The research would affirm the U.S. as a low-cost producer in today’s terms, alongside BP’s predictions below. In OPEC’s last report, it estimated:

«That North America tight crude remains a major source of non-OPEC supply growth until 2030. It reaches a maximum of 6.3 mb/d in 2027, remains flat up to 2031, before gradually dropping off to 5.4 mb/d in 2040.» (p.147)

An understanding of the potential and competitiveness of U.S. shale resources has been further advanced. OPEC has underestimated the U.S.’s shale oil competitiveness in the past. It is possible yet again. U.S. producers have had to prove themselves and their reserve potential to the market in the last few years, manifesting in nearly constant production growth in spite of an oil price bust.

Today’s shale players, comprising a hard and stable core, have reached a level of confidence, focusing more on sustainable growth. The market, however, is still adjusting to what the new normal in shale production and firm valuations should be. It’s the heterogeneity thing – or variation among wells and their respective breakevens – and the variation in holdings, or acreage locales by play, where some meaning can be found.

https://seekingalpha.com/article/4118629-u-s-shale-economics-indicate-continued-opportunity